We are pleased to announce that Michelle Eidson has joined Shorehill Capital LLC as Managing Director and head of Business Development. Michelle is responsible for Shorehill’s business development and investment sourcing initiatives. She will focus on establishing and maintaining relationships with investment banking firms, business brokers and other sources of deal flow, as well as direct calling of prospective acquisition targets.

Michelle joins Shorehill from Platte River Equity, where she was the Vice President and head of Marketing and Business Development. At Platte River, she established and executed the business development strategy for the firm. Prior to that, Michelle was the Director of Corporate Development for EchoStar Corporation, responsible for sourcing, evaluating and executing strategic partnerships, investments and acquisitions to enhance EchoStar’s technology platform. Michelle has also held roles at CIBC World Markets, Holden Capital and JPMorgan Chase. She holds a B.A. from Colby College and a M.B.A./M.A. from the University of Chicago.

Michelle can be contacted at (312) 876-0410 and meidson@shorehillcapital.com.

Actively Seeking Investments and Add-On Opportunities

If you have an opportunity that you think would be a fit with Shorehill, please contact Michelle or another member of our team. We pledge to be highly responsive to opportunities you share with us and will get back to you quickly and constructively with thoughtful questions and feedback. We operate with consistency, transparency and efficiency during the transaction process and are always looking to expand our referral sources.

About Shorehill Capital LLC

Shorehill Capital is a Chicago-based private equity firm with a passion for building better businesses. Our mission is to produce strong investment returns while maintaining a focus on capital preservation and risk diversification. For nearly 30 years, our partners have worked with business owners and management teams to accelerate growth, improve operational performance and increase asset efficiency to drive value creation. We utilize our decades of experience and our network of resources to add value to our investments. Even with our vast experience, we recognize that success can only be achieved through a well-functioning partnership with our management teams based on mutual respect and straightforward communication. As the largest investor in our fund, we believe our interests are closely aligned with our management partners, co-investors and limited partners in our pursuit of building outstanding businesses and delivering strong investment returns.

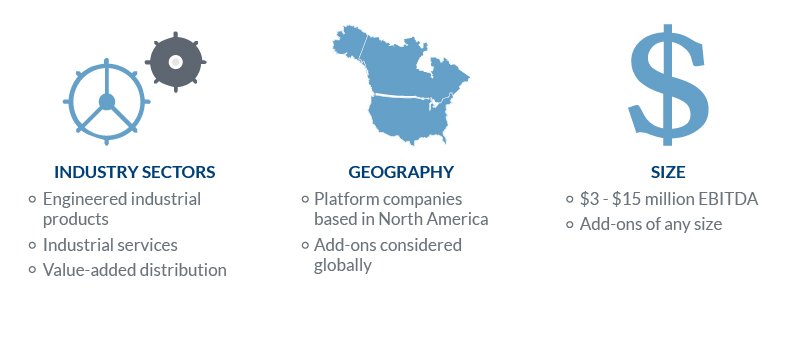

Our investment efforts are focused on making control investments in North American precision manufacturing, value-added distribution and industrial service companies. We target companies with enterprise values of between $25 million and $150 million.

We have an entrepreneurial culture and a belief that we win through open communication, teamwork and superior execution.